Farmers – an update with Bob Trunchion

Anyone needing an update into the sector as it goes through a period of dramatic change.

Anyone needing an update into the sector as it goes through a period of dramatic change.

A course to review and provide an update on the particular UK accounting and tax regime applicable to farmers. The course identifies some of the controversial and risk areas of tax planning and compliance for these clients.

Course information

Content will include:

- Where is farming today – diversification and tax impacts

- Succession planning, partnership agreements, divorce and death!

- Where are we on Brexit and the consequences for Agriculture – The Agriculture Bill

- Loss reliefs general and special legislation – “all one trade”, averaging etc – the HMRC attacks on losses

- Capital expenditure reliefs

- Basic payments and their phasing out and other subsidies

- Alternative farming arrangements – Share Farming and Contracting

- Farmhouses and IHT planning

- Where are we with BPR and APR with relevant case updates

- Entrepreneurs Relief and CGT planning

- The potential for Compliance checks and enquiries

Cost

| Rate | Cost |

| Price | £75.00 + VAT |

| Retired Member | £37.50 + VAT |

| Career Break Member | £37.50 + VAT |

M-Sport Factory tour

Join us for a tour around M-Sport.

Join us for a tour around M-Sport.

![]() Growing in size and stature since originally formed in 1997, M-Sport now operates a flourishing global motorsport business on the stages and circuits of some of the world’s most acclaimed motorsport series.

Growing in size and stature since originally formed in 1997, M-Sport now operates a flourishing global motorsport business on the stages and circuits of some of the world’s most acclaimed motorsport series.

Event information

Event information

Providing the engineering expertise behind the award-winning range of Ford rally cars as well as the Bentley Continental GT3, M-Sport has quickly become an industry leader – delivering winning performances around the globe.

Continuing to expand, M-Sport is also in the process of a vast new development with a state-of-the-art Evaluation Centre currently under construction.

Once completed, this facility will provide a centre of excellence where motorsport and automotive leaders can follow a project from concept to product all at M-Sport’s high-security base on the edge of the UNESCO English Lake District National Park.

Founded my Malcolm Wilson OBE Malcolm Wilson Motorsport Limited was founded in 1979 and changed its name to M-Sport in 1996 when the company was awarded the Ford contract for rallying as well as competition research and development.

Under Malcolm’s leadership the team enjoyed much success, including winning the FIA World Rally Championship for Manufacturers two years running in 2006 and 2007. In 2017, they secured the Manufacturers’ crown for a third time as well as their first FIA World Rally Championships for Drivers and Co-drivers.

Aside from rallying, the team also enjoys success on the racing scene. Through the reputation that M-Sport holds, Malcolm was approached by Bentley Motors Ltd in 2012 to build the Bentley Continental GT3 competition in the International Blancpain series.

Aside from rallying, the team also enjoys success on the racing scene. Through the reputation that M-Sport holds, Malcolm was approached by Bentley Motors Ltd in 2012 to build the Bentley Continental GT3 competition in the International Blancpain series.

M-Sport’s nerve center is Dovenby Hall, a former hospital that enjoys an idyllic setting in the heart of the Cumbrian countryside. The site has been extensively renovated and the old manor house now sits next to a state-of-the-art workshop.

The extensive site contains everything the team needs to function, with the vast majority of components produced in-house. The competition cars have the whole world as their stage, but everything comes together in a quiet corner of Cumbria.

Cost

Cost

| Rate | Cost |

| Price | £16.67 + VAT |

Finance Act 2019 – Penrith – with Rebecca Benneyworth

Designed for the general practitioner in an accountancy practice to provide them with up to date knowledge.

Designed for the general practitioner in an accountancy practice to provide them with up to date knowledge.

The Finance Act is expected to receive Royal Assent before the start of the 2019/20 tax year. The Bill includes measures announced in the October 2018 Budget and other changes which had been announced earlier. This course will update you on all of the changes relevant to the general practitioner.

Course information

Course content will include:

- Income Tax

- Corporation Tax

- Capital Gains Tax

- National Insurance Contributions

- VAT

- Other property Taxes

- Tax administration, including: Making Tax Digital, Inheritance Tax, Tax Avoidance and Tax Administration

Cost

| Rate | Cost |

| Price | £75.00 + VAT |

| Retired Member | £37.50 + VAT |

| Career Break Member | £37.50 + VAT |

Preparing your client for Making Tax Digital – Penrith – with Rebecca Benneyworth

Rebecca Benneyworth will provide you with the latest developments in Making Tax Digital.

Rebecca Benneyworth will provide you with the latest developments in Making Tax Digital.

To provide a full understanding of the current state of implementation of the Making Tax Digital project.

Course information

Content

MTD for VAT

• What the law requires

• Transition to the new system

• Options for those not within mandation

• HMRC guidance

• MTD for income tax

Proposed timetable

• Progress of the pilot

• Preparing your practice

• Preparing your client

MTD for corporation tax

• The proposals

Target audience

The course will appeal mainly to members in practice. Members in business may find the VAT content useful.

Cost

| Rate | Cost |

| Price | £75.00 + VAT |

| Retired Member | £37.50 + VAT |

| Career Break Member | £37.50 + VAT |

Halloween Pan professional quiz

Join us for our pan professional quiz.

Join us for our pan professional quiz.

A fantastic opportunity to network with professional service contacts throughout North Cumbria.

(Solicitors, Bankers, Accountants, Surveyors, Independent Financial Advisers…… YOU!)

Event information

There will be a Hot Buffet supper of lasagne or chicken curry (if you have any dietary requirements please let us know at point of booking).

You will be allocated to a team of 6 to enable you to network with a variety of other local professionals throughout the evening.

Cost

| Rate | Cost |

| Price | £9.17 + VAT |

CABA – Do more in a day than in a week

Always wanted to be more productive? Attend the CABA ‘Do more in a day than in a week’ workshop and you just might achieve it.

Join us for a CABA workshop on enhancing your productivity. The event will last for roughly two hours and includes a hot buffet meal during.

Join us for a CABA workshop on enhancing your productivity. The event will last for roughly two hours and includes a hot buffet meal during.

Event information

Great way to improve productivity and gain new tips on ways to be more efficient at work.

Cost

| Rate | Cost |

| Price | Free |

Speaker – Jenni Rose

Since qualifying with one of the big four firms as a Chartered Accountant, Jenni has worked closely with chartered accountants and business professionals to help them increase their resilience, self awareness, emotional intelligence and day to day fulfilment.

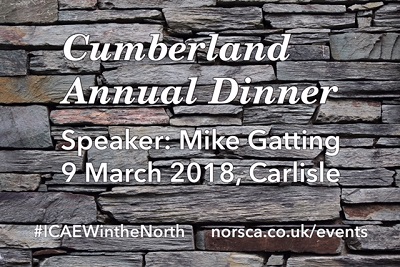

Cumberland Society of Chartered Accountants Annual Dinner

On behalf of the Cumberland Society of Chartered Accountants Clare Garrison is delighted to invite you to their Annual Dinner on Friday 9 March 2018 at The Halston Aparthotel, Carlisle at 19:00 for a 19.30 start.

On behalf of the Cumberland Society of Chartered Accountants Clare Garrison is delighted to invite you to their Annual Dinner on Friday 9 March 2018 at The Halston Aparthotel, Carlisle at 19:00 for a 19.30 start.

The dinner, which is black tie, will commence with a drinks reception at 19:00 attended by a photographer from Carlisle Living Magazine.

A three course meal will be served from 19.30 followed by speeches from the chair and our ICAEW guest and will also include a raffle in aid of a local charity, the Great North Air Ambulance.

Tables of 8 and 10 will be available along with mixed tables for individual members wishing to attend.

We want to give our guests a choice of starter, main and dessert however this must be pre-ordered

Menu

STARTERS

Chicken Liver Parfait(NF)

Homemade chutney, rustic Melba toast and mixed baby leaf

White Bean and Bacon Soup (GF) (NF)

Smoked Brie Mousse (V) (NF)

With vegetable crisps and grissini bread sticks

MAIN COURSE

Roast Chicken Supreme (GF) (NF)

Honey roast carrots and parsnips, fondant potato with a red wine jus

Braised Blade of Beef (GF) (NF)

Grain mustard mash, roast root vegetables, broad beans with a thyme jus

Baked Salmon (GF) (NF)

Lemon and caper crushed new potatoes, roast fennel, brown shrimp and lemongrass velouté

Feta, Olive and Tomato Tartlets(V)

DESSERT

Homemade sticky toffee pudding

butterscotch sauce and cinnamon ice cream(V) (NF)

Chocolate brownie

white chocolate and marshmallow ice cream

Lemon and lime posset

tamarillo and basil jam, with pistachio, white chocolate and cranberry biscotti

Please could you indicate at time of booking your choice of menu where no choices are provided we will assume that the following “standard three course meal” has been chosen; White Bean and Bacon Soup, Braised Blade of Beef and Chocolate Brownie.

Tax planning for the family company

The aim of the course is not just to remind people of the current rules governing the taxation of Family Companies but also the traps. It is also to make sure that they are aware of how all the new developments in tax etc. fit into the advice given daily to clients.

The aim of the course is not just to remind people of the current rules governing the taxation of Family Companies but also the traps. It is also to make sure that they are aware of how all the new developments in tax etc. fit into the advice given daily to clients.

Changes on IR35, the new rules on disguised remuneration impact this sector as do the restrictions on dividends making traditional advice more complex

This course looks at the life of the average family business from set up to sale from a taxation point of view.

Content

• Incorporation

o Should we incorporate?

o Capital gains implications, including the transfer of intangibles (not goodwill?)

• Share structure – husband and wife companies, dividend waivers, nursery/school/university fees

• Financing the company

o Sources of finance available, including taking advantage of Seed EIS

• Close company provisions, in particular the rules for loans to participators and the interaction with the disguised remuneration rules

• Tax efficient extraction of funds from the company

• Capital tax planning and the new pension freedoms

o Transferring the family company – CGT and IHT issues

o Selling the family company

o Liquidations and tax efficient striking off of the company, especially cash rich companies, transactions in securities and all the new anti-avoidance

The course will include a number of case studies to illustrate the relevant points.

The Compliant Practitioner

Everyone in an accountancy practice responsible for the firm’s compliance with professional standards.

Everyone in an accountancy practice responsible for the firm’s compliance with professional standards.

You will gain confidence that you are keeping on top of your compliance obligations and will have the opportunity of asking questions of our expert and well informed speaker.

Course information

The course content will reflect changes in practice regulations, it will typically include:

Practice administration issues – drawing on feedback from the professional bodies:

o Practice communications

o Regulatory compliance – review of the implementation of The General Data Protection Regulations, and, the revised anti money laundering regulations

o Professional Indemnity Insurance

o Dealing with client money

Risk management and client service – looking at practical aspects of servicing clients while ensuring the firm is not exposed to unexpected risks:

o Topical engagement/ disengagement issues

o Topical reporting issues, including certificates and other confirmations

o Recent professional guidance on risk management

Practical problems and issues – a review of recent technical changes (last 2-3 years), providing a refresher on the key points and examining their impact in practice

Disciplinary cases – a review of cases which contain lessons for us all.

The course is a half day lecture. Delegates are encouraged to ask questions and share experiences for the benefits of others.

Cost

| Rate | Cost |

| Price | £75.00 + VAT |

| Retired Member | £37.50 + VAT |

| Career Break Member | £37.50 + VAT |

Accounting and auditing for charities

This course looks at the current and future challenges for charities, presented by changing accounting and auditing standards and changing legislation. It also looks at how well charities dealt with FRS 102 and the new SORP as well as other topical issues.

This course looks at the current and future challenges for charities, presented by changing accounting and auditing standards and changing legislation. It also looks at how well charities dealt with FRS 102 and the new SORP as well as other topical issues.

Content will include:

• The Charity SORPs

• The implications of FRS 102 for charities and the triennial review

• Accounting for gift aid payments

• Audit exemption for charities

• What makes auditing a charity special?

• Charity audit reports

• Reliance on third parties such as investment managers

• Other charity reporting issues

News

EGM called by Northern Society of Chartered Accountants

19 September 2023

Notice is given that the Northern Society...

Finalists for 2023 Northern Society Awards announced

4 September 2023

Northern Society of Chartered Accountants is delighted...

Vera author Ann Cleeves to speak at business dinner

3 September 2023

Northern Society of Chartered Accountants is delighted...